FL DoR DR-1214 2016-2026 free printable template

Show details

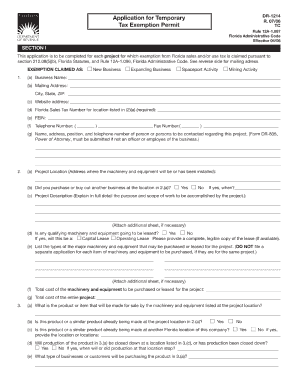

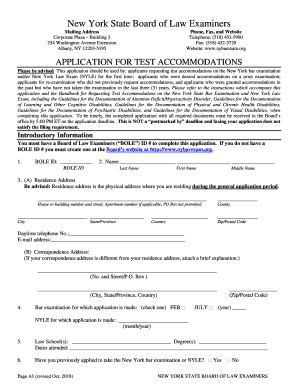

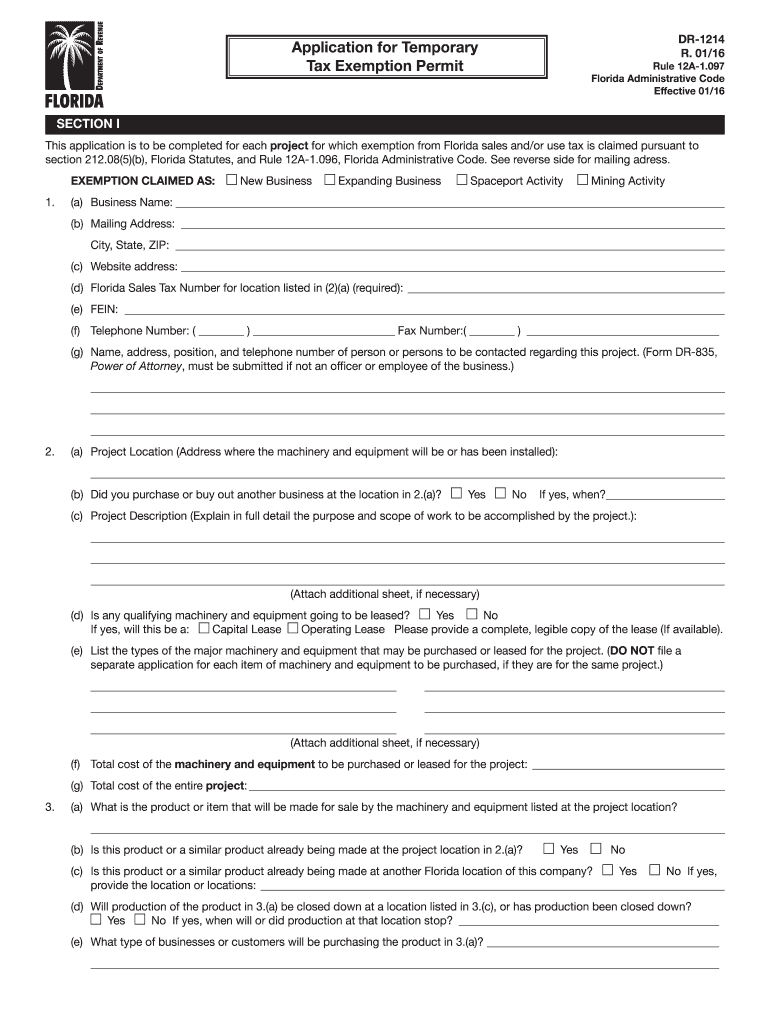

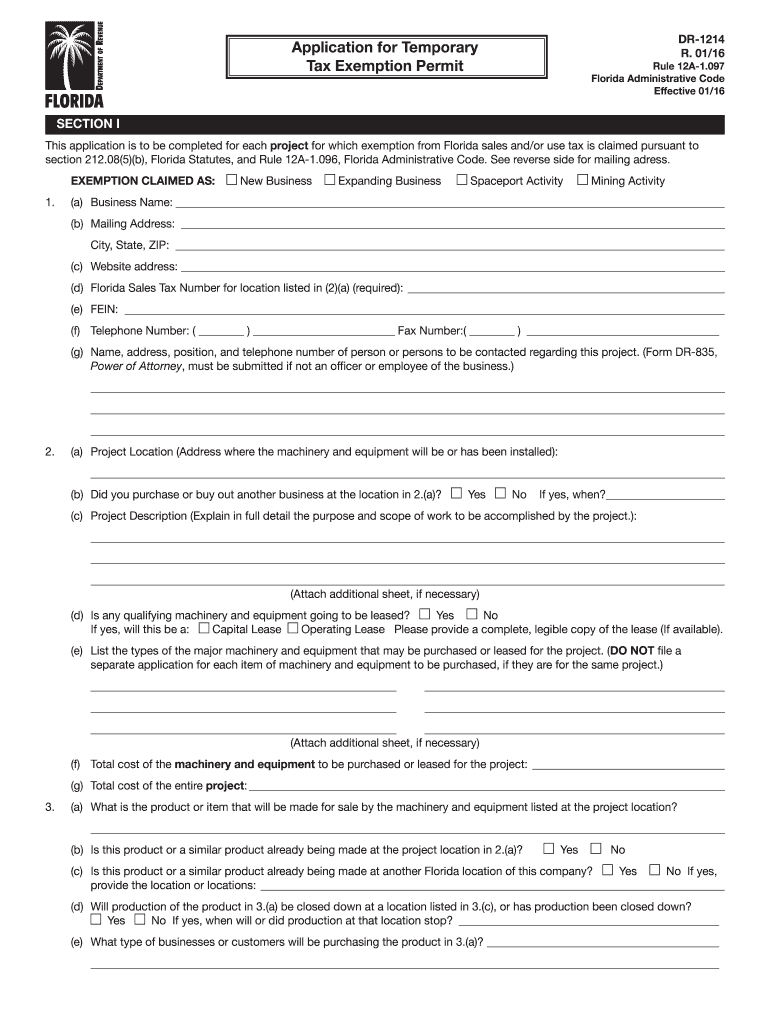

DR-1214 R. 01/16 Application for Temporary Tax Exemption Permit Rule 12A-1.097 Florida Administrative Code Effective 01/16 SECTION I This application is to be completed for each project for which

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dr 14 form

Edit your form dr 14 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 14 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dr 14 florida online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax exempt form florida. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-1214 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out florida tax exempt form

How to fill out FL DoR DR-1214

01

Obtain the FL DoR DR-1214 form from the Florida Department of Revenue website or your local tax office.

02

Fill in your personal details at the top of the form, including your name, address, and taxpayer identification number.

03

Specify the type of transaction or event that requires the filing of the form.

04

Provide any necessary details regarding the property or transaction related to the form.

05

Review the instructions section of the form for any specific guidance related to your situation.

06

Sign and date the form at the bottom before submitting it to the appropriate department.

Who needs FL DoR DR-1214?

01

Any individual or business entity in Florida that is involved in certain tax-related transactions or needs to report specific tax information may need to fill out FL DoR DR-1214.

Fill

florida form dr 14

: Try Risk Free

People Also Ask about dr14 form florida

What does it mean to apply for exemption?

To exempt a person or thing from a particular rule, duty, or obligation means to state officially that they are not bound or affected by it.

How do I claim exemption on my tax form?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

What does it mean to claim exemption on tax form?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Should I claim exemption on tax form?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

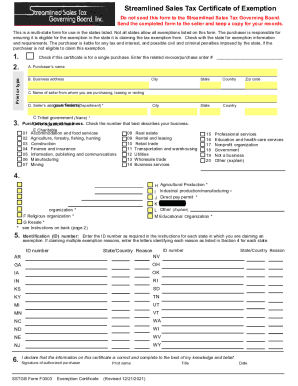

What is an exemption document?

An exemption or resale certificate is a form or document issued by a business to ensure sales tax is not applied to their invoice when they intend to resell their purchase. Sales tax is not used on these purchases because the applicable sales tax will be used on the final sale of the exchanged tangible property.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What does it mean to be filed as an exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

What is an exemption and how does it work?

A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

How many exemptions should I claim?

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

Should I claim exemption from withholding?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dr14 form directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form dr 14 florida and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I fill out dr 14 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign military form dd 2656 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit florida tax exempt certificate on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute florida dr 14 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is FL DoR DR-1214?

FL DoR DR-1214 is a form used by the Florida Department of Revenue to report and remit state sales and use tax collected by businesses operating in Florida.

Who is required to file FL DoR DR-1214?

Businesses and individuals who collect sales and use tax in Florida are required to file FL DoR DR-1214.

How to fill out FL DoR DR-1214?

To fill out FL DoR DR-1214, you need to provide detailed information including your business name, address, account number, the period covered by the report, total sales, amount of tax collected, and any exemptions claimed.

What is the purpose of FL DoR DR-1214?

The purpose of FL DoR DR-1214 is to ensure the state collects accurate sales and use tax from businesses, which is crucial for funding public services and infrastructure.

What information must be reported on FL DoR DR-1214?

The information that must be reported on FL DoR DR-1214 includes total taxable sales, total sales tax collected, and any adjustments or deductions for returns and allowances.

Fill out your FL DoR DR-1214 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida Dr 14 Form is not the form you're looking for?Search for another form here.

Keywords relevant to florida sales tax exemption certificate

Related to tax exempt certificate florida

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.