Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

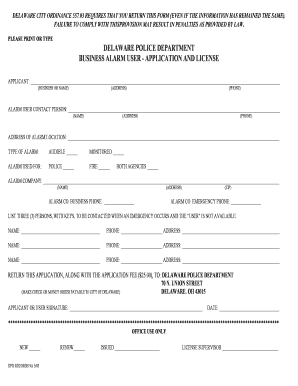

What is exemption permit?

An exemption permit is a document that grants an individual, organization, or entity exemption from certain laws, regulations, or requirements. It allows the holder to legally deviate from the standard rules or obligations that others are required to follow. Exemption permits are typically issued in specific circumstances where it is deemed appropriate to waive or modify certain provisions for specific reasons, such as when granting special privileges or allowing exemptions for religious, medical, or other legitimate purposes. These permits provide legal protection and authorization for the exempted actions or operations.

Who is required to file exemption permit?

The individuals or organizations who are required to file an exemption permit vary depending on the jurisdiction and specific requirements. Generally, it can include:

1. Non-profit organizations: Certain non-profit organizations, such as charitable, religious, or educational institutions, may be required to file for exemption permits to enjoy tax-exempt status.

2. Businesses and individuals: In some cases, businesses or individuals may need to file for exemption permits for various reasons, such as tax exemptions or specific industry permits.

3. Government entities: Some government entities may need to obtain exemption permits for specific activities, such as public events or construction projects.

It is important to consult with the relevant government agency or tax authority in your jurisdiction to determine who is required to file an exemption permit in your specific case.

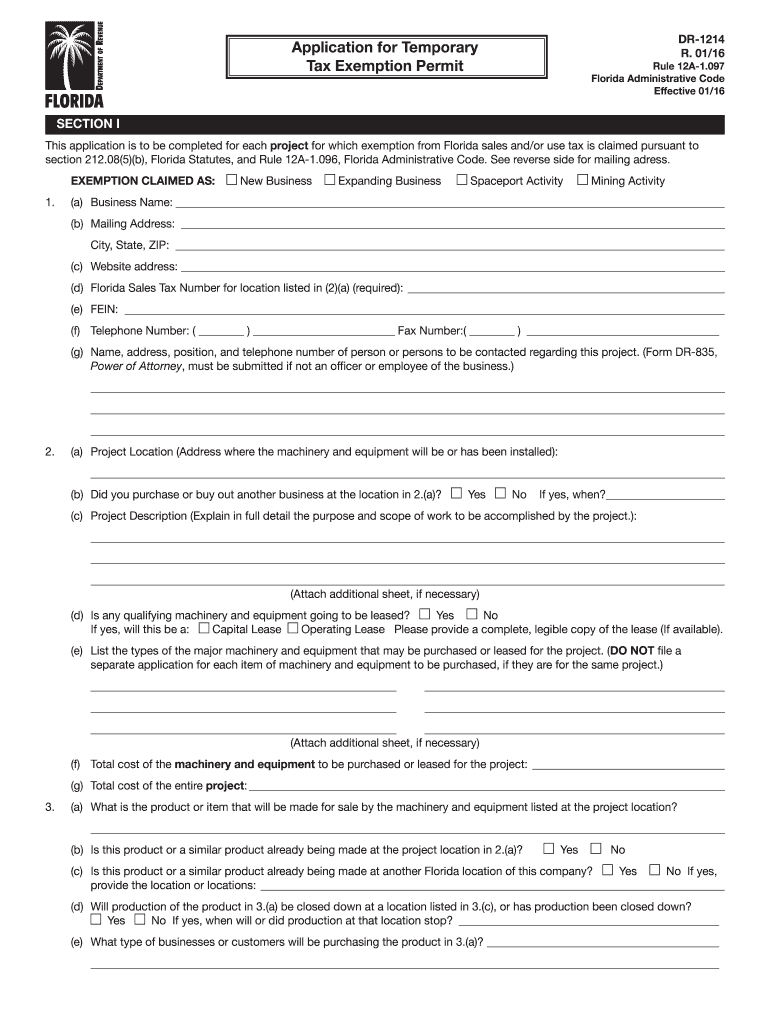

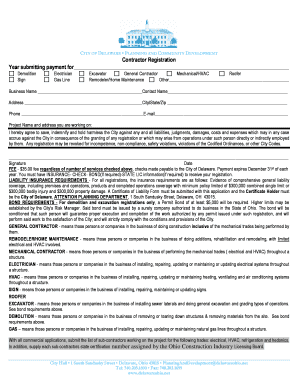

How to fill out exemption permit?

To properly fill out an exemption permit, follow these steps:

1. Obtain the exemption permit form: Obtain the specific exemption permit form that applies to your situation. These forms are typically available online on the website of the relevant government department or agency.

2. Read the instructions: Thoroughly read the instructions provided with the form. Make sure you understand the requirements and any supporting documents that may be needed.

3. Provide personal information: Fill in your personal information accurately and completely. This may include your name, address, phone number, email, and other relevant details as required.

4. State the purpose of exemption: Clearly state the purpose of your exemption request. Explain why you believe you qualify for an exemption from the specific requirement or regulation. Be concise and ensure your explanation aligns with the criteria specified by the governing body.

5. Attach supporting documents: If requested, provide any necessary supporting documents along with the permit form. These documents may include identification, proof of residency, medical certificates, or any other evidence required to support your exemption.

6. Review and sign the form: Before submitting the permit, carefully review all the information provided to ensure accuracy and completeness. Once you are satisfied that everything is correct, sign and date the form as required.

7. Submit the form: Submit the completed form along with any supporting documents to the appropriate government agency or department. Follow the instructions provided to ensure it is submitted by the given deadline.

8. Keep copies: Make copies of the filled-out permit form and any supporting documents for your records. These copies may be required for future reference or if any issues arise regarding your exemption.

Remember to check the specific instructions and requirements associated with the exemption permit you are applying for, as they may vary depending on the jurisdiction and the purpose of the exemption.

What is the purpose of exemption permit?

An exemption permit is a document that allows an individual or entity to be exempted from a certain law, regulation, or requirement. The purpose of an exemption permit can vary depending on the specific situation, but generally it is to provide an exception for specific circumstances where adhering to the law or regulation would be impractical, unnecessary, or create a burden.

Some common purposes of exemption permits include:

1. Regulatory flexibility: Exemption permits can provide flexibility to individuals or businesses to deviate from certain regulations or requirements that may not be applicable or feasible in their specific case.

2. Economic incentives: Exemption permits can be used to encourage specific economic activities or industries by exempting them from certain taxes, fees, or regulations.

3. Safety and security: In some cases, exemption permits may be issued for emergency or security reasons, allowing certain individuals to bypass certain checkpoints or restrictions to ensure safety or respond efficiently to emergencies.

4. Research or experimental purposes: Exemption permits can be used to grant permission for conducting research or experiments that may otherwise be prohibited or restricted by laws or regulations.

5. Special circumstances: Exemption permits can also be granted on a case-by-case basis for individuals facing unique or extraordinary circumstances that necessitate an exception from standard rules or requirements.

Overall, the purpose of an exemption permit is to provide a legal means for individuals or entities to deviate from specific laws or regulations, ensuring that fairness, practicality, and exceptional circumstances are taken into account.

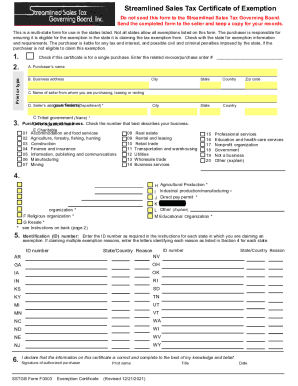

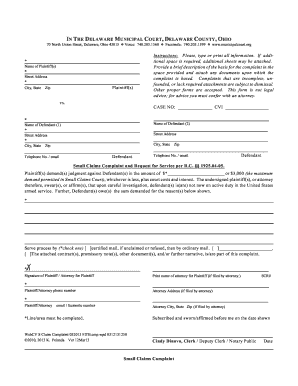

What information must be reported on exemption permit?

The specific information that must be reported on an exemption permit can vary depending on the jurisdiction and the type of exemption being sought. However, some common information that may need to be reported includes:

1. Applicant's name and contact information: The individual or organization seeking the exemption permit should provide their full name, address, phone number, and email address.

2. Reason for the exemption: The applicant should clearly state the reason for requesting an exemption. This could be related to a particular law, regulation, or requirement that they believe should not apply to them.

3. Relevant laws or regulations: The applicant should identify the specific laws, regulations, or requirements that they are seeking an exemption from. It may be necessary to provide the exact citations or references to these laws.

4. Justification for the exemption: The applicant should provide a detailed explanation of why they believe they should be granted an exemption. This may include describing any unique circumstances, unusual hardships, or other factors that support their request.

5. Supporting documentation: Depending on the nature of the exemption request, the applicant may need to provide supporting documentation. This could include legal opinions, expert reports, financial statements, or any other evidence that helps to substantiate their claim for exemption.

6. Signature and date: The exemption permit application may need to be signed and dated by the applicant or an authorized representative. This confirms that the information provided is accurate and complete.

It is important to note that the specific requirements for exemption permits can vary significantly depending on the applicable laws and regulations. It is recommended to consult the relevant authorities or seek legal advice for accurate and up-to-date information on the exact details that should be included in an exemption permit application.

What is the penalty for the late filing of exemption permit?

The penalty for the late filing of an exemption permit may vary depending on the specific jurisdiction and regulations in place. It is best to consult local laws or contact the appropriate government agency or department to determine the specific penalty for late filing in a particular case.

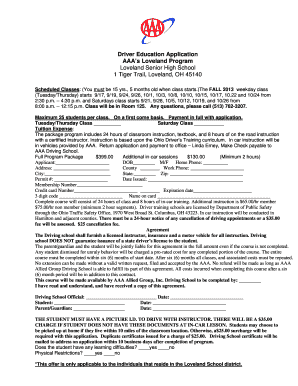

How can I manage my exemption permit directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your exemption filing form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I fill out application exemption using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign dr 1214 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit 1214 tax on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute how to exemption permit form from anywhere with an internet connection. Take use of the app's mobile capabilities.